Important 1099-R Filing Destinations in 2026: The Taxpayer-Friendly Guide.

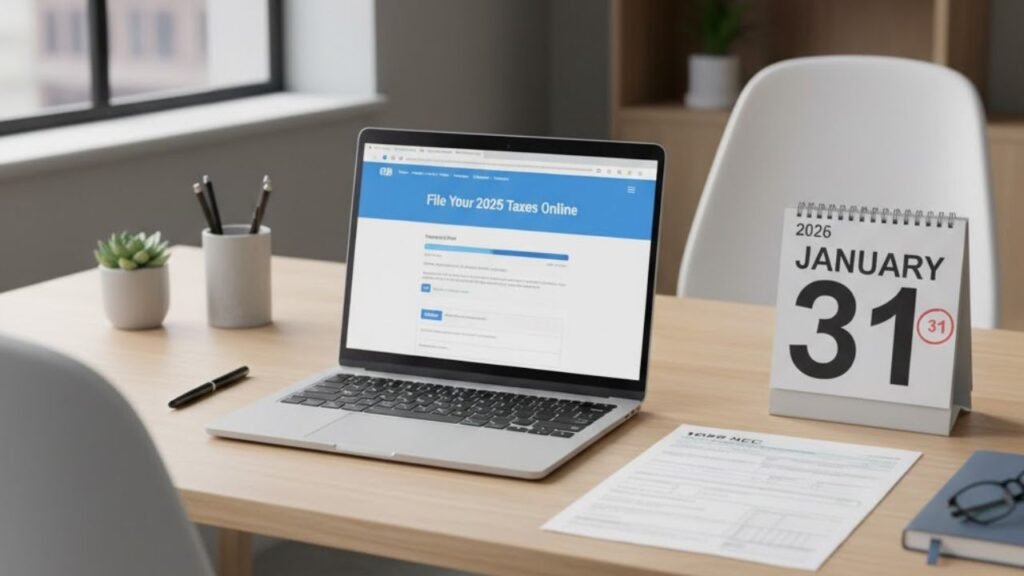

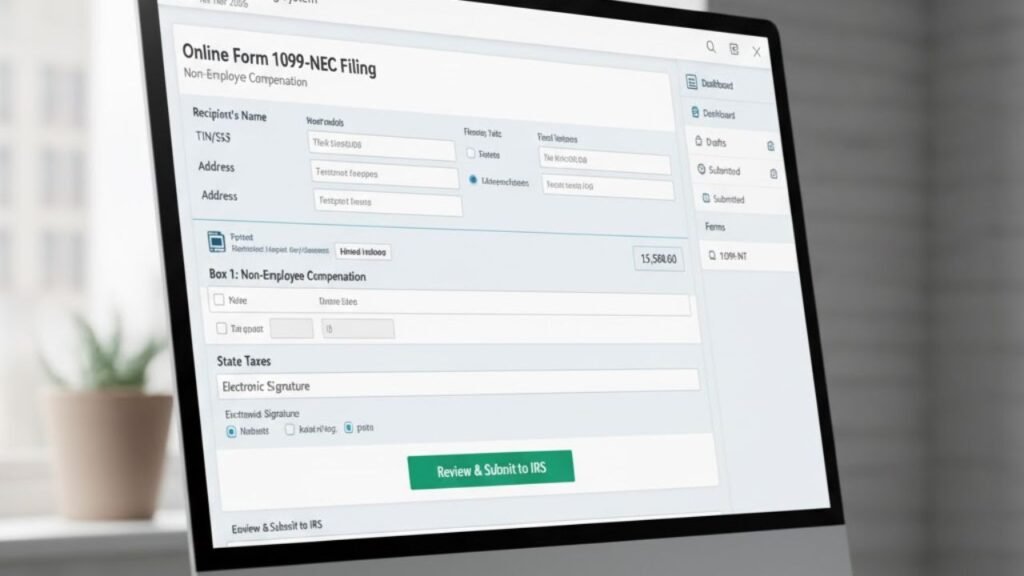

Form 1099-R is used to report on distributions that occur as a result of pensions, annuities, retirement or profit, and sharing plans, IRA, and insurance contracts. In case these payments or receipts are received or paid in 2025, the filer shall file Form 1099-R to the IRS and also furnish copies to the recipients by […]

Important 1099-R Filing Destinations in 2026: The Taxpayer-Friendly Guide. Read More »