Prepare e-file IRS 1099 K Tax Form, NEC, MISC, INT, DIV, R, A for 2024 File 1099 Forms Online

File IRS 1099 K Form 2024

- File 1099 K Tax Return online & save time along with money.

- Pay when you are ready to transmit 1099 K Forms to the IRS with Form1099Online.

- Sign Up for a free e-file account & file numerous 1099 Forms online anywhere at any time.

- File 1099 Tax Forms online conveniently with zero errors.

- Use the advanced e-filing feature and begin filing your 1099 K Form now!

Table of Contents

What is 1099 K Form Tax Return Used For?

1099 K is primarily used to report payment card transactions made in a calendar year. Compared to other 1099 Forms, this tax return specifically reports the payments made to a contractor via credit/debit cards or any third-party networks. A payment card includes:

- Stored-value cards.

- Gift cards

- Debit/credit cards etc.

Third-party networks include Amazon, PayPal, etc in which third-party authentication requires to process the payments.

When do you qualify for a 1099 K Form?

As per the IRS norms, not everyone who uses third-party networks or any payment cards receives a fillable 1099 K 2024. Instead, a business is qualified to receive an IRS 1099 K if:

- The payments are made to an employee who is not using any payment cards like credit/debit, stored-value cards, gift cards, etc.

- Any third-party networks are involved to make the payments.

- The individual services processed by the third-party networks exceed $20,000 in a tax year.

- Individual transactions made exceed $200 in a calendar year.

Apart from the above payments from 2025, the payee must issue a 1099 K return if the services are processed to meet the 1099 K threshold 2025 i.e., more than $600. These payments are regardless of individual transactions.

Who sends an IRS 1099 K Form?

Payment Settlement Entity sends a 1099 K to the individuals to report the payments made through payment cards. If you made payments to contractors using credit/debit/Amazon/PayPal, then the PSE sends you an IRS 1099 K. PSE is responsible to file tax returns because the PSE instructs you to transfer funds to the participating payee account. A PSE is a domestic/foreign entity, a bank, or an organization committed to making payments to participating payee. The participating payee is an individual who accepts payment card or third-party network transactions.

How to complete an IRS 1099 K?

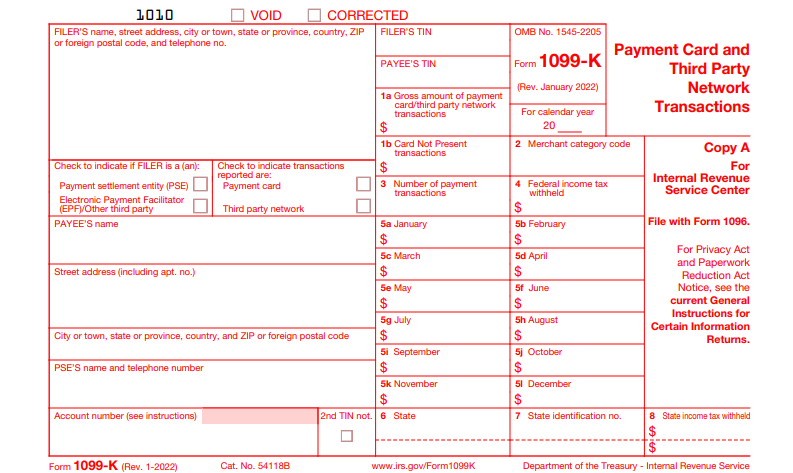

1099 K reporting requirements are: Payer & payee details Provide the payer and payee details like name, TIN, & address in the respective boxes. The transaction reported checkboxes Check the first top box if you are reporting payment card transactions. Or else, check the second top box if you are reporting third-party network transactions. Box 1a – Gross payment card/third-party network transactions. 1b – Card not present transaction 2 – Merchant category code. 3 -Number of payment transactions. 4 – Federal tax withheld. 5a-i – Appropriate gross amount for each month in a year. 6-8- State Information.

Fillable 1099 K Important Dates

Here are the deadlines to issue multiple 1099 K copies: IRS 1099 K Copy A to the IRS – February 28th, 2025 (paper filing); March 31st, 2025 (e-filing); Printable Form 1099 K Copy B to the contractor – January 31st, 2025; Copy 1 to the State Tax Departments if your state requires to file 1099 K.

E-file 1099 K instructions 2024

Here are the instructions on how to file 1099 K online:

- Sign up with an IRS-trusted e-file provider. Or else, log in to the existing e-file account.

- New users can add the business details.

- Returning users can select the business information for which 1099 K is required.

- Select the “IRS 1099 K” from the dashboard.

- Fill in the necessary details.

- Recheck the information entered before submitting it to the IRS.

- Transmit the tax returns to the IRS & the contractor within the key date.

How does e-filing 1099 K with Form1099online.com work?

Filing 1099 K Tax Forms online with Form1099online.com is 100% safe & secure. We are the IRS trusted e-file provider providing 256-bit security encrypted software. Our e-filing services are cloud-based & secured from third-party networks. Solve your filing time queries in seconds with our US-based customer support team available via chat, email, text, or call.

Read More Related Information About 1099 K Form

IRS 1099 K Tax Form- Top 5 Interesting Facts

Do 1099 K Form Reporting Rules Burden the Casual Sellers in the US?

Filing IRS Form 1099 K – Top 5 Things to Remember

Do I need to send a contractor a 1099 MISC or 1099 K or 1099 NEC?

What are the major changes the IRS made in 1099 K reporting?

Form 1099 K Vs 1099 NEC: Which Form to Use for 2022?

Efile 1099 K: What Cryptocurrency Should Know about for 2022?