Prepare e-file IRS 1099 NEC, MISC, INT, DIV, R, A & K for 2025File 1099 Forms Online

E-file IRS Form 1099 NEC Online for 2025 in Minutes

- Easily prepare your Form 1099 NEC in just minutes it’s that easy.

- If you are due to E-file the 1099 NEC Form for the tax year 2024 and need to do it online, Form1099Online is for you.

- Form1099Online is the most reliable and secure way to file your 1099 NEC tax returns online.

- The sign-up process takes less than a minute, and e-filing is fast and easy.

- Easily file 1099 NEC electronically and experience hassle-free integration.

- The fastest 1099 e-file service in the industry, offering you a seamless experience with no complicated steps.

Table of Contents

- Nonemployee Compensation Form 1099-NEC for Tax Year 2025

- Form 1099-NEC Information in Numbered Boxes

- Form 1099-NEC Box 1 – Nonemployee compensation

- Form 1099-NEC Box 2 – Payer made direct sales of $5,000 or more consumer products for resale

- Form 1099-NEC Box 4 – Federal income tax withheld

- Federal Form 1099 NEC Boxes 5-7. State Information

- IRS 1099 NEC Form Deadlines

- How to file a 1099 non-employee compensation form online quickly?

- What is a Trade or Business for Form 1099-NEC Reporting?

- What are IRS Exceptions for Reporting Payments on Form 1099-NEC?

- The IRS Form 1099-NEC: How Payers Distribute and Submit It

- What if the information on Form 1099-NEC Is incorrect?

Nonemployee Compensation Form 1099-NEC for Tax Year 2025

IRS Form 1099-NEC tracks the income and expenses of businesses made to non-employees in a tax year. Non-employees use this form to track the total annual payments they receive for tax time reporting. Form 1099-NEC is issued to non-employee contractors and is used by the IRS to track who received payments during the year. Because 1099-NECs expose individuals receiving payments, they alert the IRS if they don’t self-report and pay their taxes. A legal requirement for reporting this information to the IRS is met if an employer sends out a form 1099-NEC to an employee or independent contractor on or before January 31st in the following calendar year.

For example:

If you are filing the 1099-NEC Tax Form in February 2025, it is indicated that the tax form is for the calendar year 2025, i.e., the payments made in 2024 are reported in 2025.

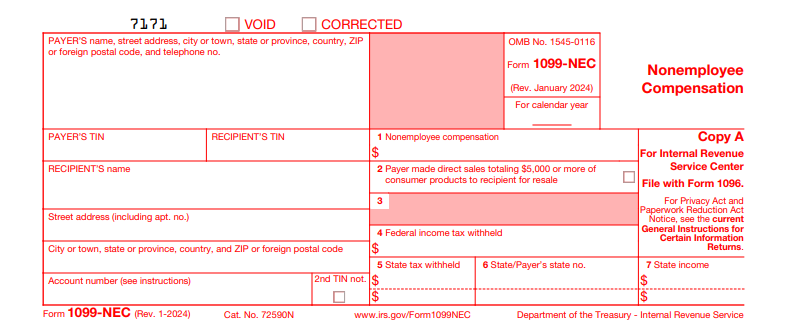

Form 1099-NEC Information in Numbered Boxes

The Form 1099-NEC’s numbered boxes are:

- Nonemployee compensation

- Direct sales totalling $5,000 or more of consumer products for resale.

- Not used

- Federal income tax withheld.

- State tax withheld

- State/Payer’s state no.

- State income

Form 1099-NEC Box 1 – Nonemployee compensation

IRS Form 1099 NEC box 1 is used to report non-employee compensation of $600 or more for services that are related to the business. So, fill out Box 1 of the tax form for non-employee compensation that includes:

- Attorney fees, commissions, awards, or prizes received for non-employee services.

- Petroleum and gas dividends for working interest.

- Payments are paid to suppliers by federal executive agencies.

- Payments are made for services rendered in the course of business or trade.

Form 1099-NEC Box 2 – Payer made direct sales of $5,000 or more consumer products for resale

Box 2 of the 1099 NEC Form reports the direct sales of $5,000 or more of consumer products for resale. Check the box if the payer made direct sales. Make sure not to include the payment amount in this box. This box doesn’t need any information, so if it doesn’t apply to you, leave it empty.

Form 1099-NEC Box 4 – Federal income tax withheld

Box 4 of the IRS 1099 NEC Form reports backup withholding taxes. Backup withholding taxes of the payments reported in box 1 are subjected when the payer doesn’t furnish their Taxpayer Identification Number to you.

If a contractor, for instance, fails to give you their Social Security number or federal taxpayer identification number, they would be subject to backup withholding. So, requesting a signed Form W-9 from your contractors before paying them is essential.

Federal Form 1099 NEC Boxes 5-7. State Information

Include state income taxes that were withheld in box 5. Box 6 of the form must be filled out with the state’s abbreviated name and the payer’s state ID number. In box 7, please provide the state payment amount.

IRS 1099 NEC Form Deadlines

The Due Dates to E-file 1099 NEC Form For 2024-25to the contractors & the IRS are on the same date. IRS 1099 NEC Form is due to the IRS and to the contractor annually on “January 31st of the following calendar year”.

For the 2024 tax year, taxpayers must file Form 1099 NEC Online & send copy B to the contractor and Copy A to the IRS on “January 31, 2025”.

How to file a 1099 non-employee compensation form online quickly?

Filing your 1099 tax returns manually can be a tedious, time-consuming process. You will spend hours preparing and printing the forms and packages you need to send off to the IRS for approval. But now, you can file your 1099s online. E-file 1099 NEC Form makes it easy for you to stay compliant with the law and avoid fines.

Filing the 1099 non-employee compensation form online is easy and quick if you choose an “IRS trusted e-file provider like Form 1099 online.

Sign up by providing your email address and phone number & start filing your 1099 tax returns by adding the necessary information hassle-freely. Enter the amount paid to the independent contractor in the respective boxes. Also, don’t forget to review the tax return before submitting it to the IRS because the IRS imposes penalties along with interest if you provide fraudulent information.

What is a Trade or Business for Form 1099-NEC Reporting?

As per IRS 1099 NEC Form general instructions, businesses that are operated to earn profits or gains are considered trade or business. Nonprofits and other organizations included in the IRS Instructions for Form 1099-NEC are trade or business. On Form 1099-NEC, filers should not include personal payments.

The IRS Form 1099-NEC instructions state that:

Other entities subject to these reporting requirements include trusts of a qualified pension or profit-sharing plans of employers, specific entities exempt from tax under section 501(c) or 501(d), farmers’ cooperatives exempt from tax under section 521, and widely held fixed investment trusts.

What are IRS Exceptions for Reporting Payments on Form 1099-NEC?

The following exemptions for reporting payments on Form 1099-NEC:

- Payments to corporations, including limited liability companies (LLCs), C or S corporations.

- Compensation is made for merchandise, telegrams, telephones, freight storage, and similar items.

- Employee Wages.

- Rent payments to property managers or real estate agents.

- Employees who receive military differential pay or other uniformed services while serving in the military.

- Business travel allowances, cost of current life insurance protection.

- Payments are made to tax-exempt organizations, such as trusts, the United States, a state, the District of Columbia, a U.S. possession, or a foreign government.

- Compensation is made for illness or injuries by the Department of Justice as a disability or survivor’s benefit.

The IRS Form 1099-NEC: How Payers Distribute and Submit It

Business owners send a copy of the completed 1099 NEC Form to the payee, the IRS, and the states. The payer can manually send all the respective 1099 NEC Tax Returns and transmit form 1096 to the IRS. IRS Form 1096 is an Annual Summary and Transmittal form of US information returns.

Taxpayers can both fill out the tax return and submit the 1099 NEC Form Tax Form copies electronically with an IRS-authorized Form 1099 e-file provider like Form1099Online.

Note: Since the 1099 forms are not scanned, downloading them from the IRS website is not permitted. Payers who provide 1099s that cannot be scanned may be subject to fines from the IRS.

What if the information on Form 1099-NEC Is incorrect?

If the payee receives an incorrect 1099 NEC Tax Form, he/she should ask the payer for a corrected copy. When submitting the tax return, the recipient should include the correct information and a letter of justification if the payer doesn’t provide a revised form.

Read More Related Information About 1099 Nec Form

How do you create and e-file 1099 NEC?

Form 1099 NEC vs. 1099 MISC- What’s New for 2021

IRS Form 1099 NEC 2021- What payments are reported?