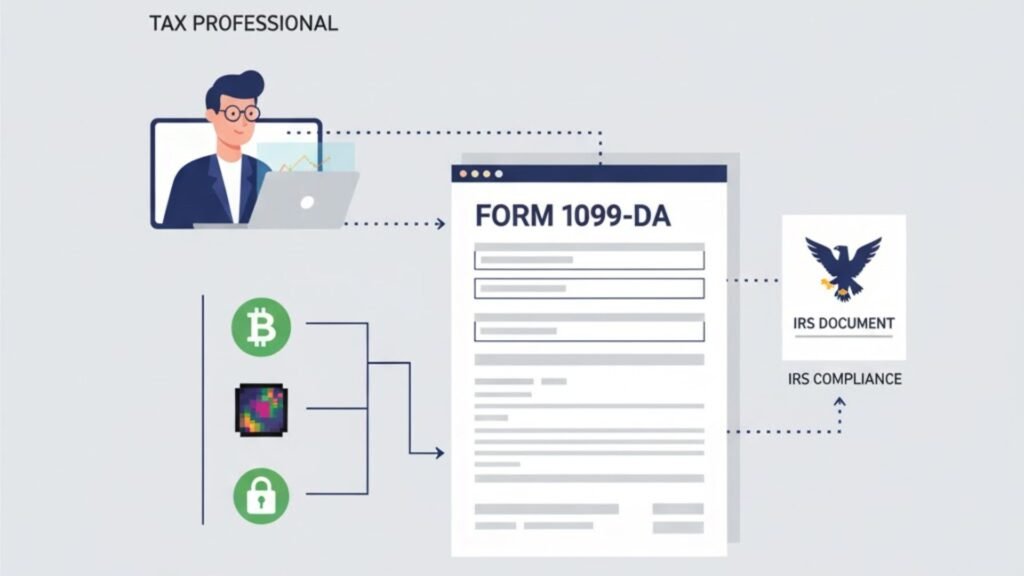

The IRS has announced new reporting rules for digital asset transactions. Starting January 1, 2025, brokers dealing with digital assets must begin reporting these transactions using Form 1099-DA.

These rules are part of a broader plan to bring more clarity and compliance to digital asset reporting, similar to how traditional securities are reported today. For tax professionals, this change means new responsibilities, tighter reporting timelines, and the need for accurate client records.

Table of Contents

Scope of the New Rule

The reporting requirement applies to a broad group of brokers who handle digital assets.

Who is covered:

- Centralized crypto exchanges

- Custodial wallet providers

- Digital asset payment processors

Who is currently exempt:

- Entities engaged in decentralized finance (DeFi) activities

- Non-custodial platforms (at least until future guidance is issued)

This means tax professionals should carefully identify which client activities are covered and which are not.

Key Timeline

The implementation of this rule is phased to give brokers, taxpayers, and tax preparers time to adjust.

| Date | Requirement |

|---|---|

| January 1, 2025 | Brokers start reporting gross proceeds from digital asset transactions |

| Early 2026 | Taxpayers start receiving Form 1099-DA statements for their 2025 returns |

| January 1, 2026 | Basis reporting begins for covered transactions |

This timeline gives 2025 as a transition year where tax professionals can help clients build proper recordkeeping systems before basis reporting becomes mandatory.

What Form 1099-DA Captures

Form 1099-DA is designed to make digital asset reporting more transparent. It captures the following key details for each transaction:

- Date of acquisition

- Date of sale or disposition

- Cost basis

- Sale proceeds

- Type of digital asset (cryptocurrency, NFTs, or stablecoins)

This information will be sent both to the taxpayer and the IRS. The goal is to reduce underreporting of crypto transactions and align this area with how stocks and bonds are reported.

Basis Reporting and Recordkeeping

One of the most important points for tax professionals is cost basis reporting.

In the first year (2026 statements for the 2025 tax year), most 1099-DA forms will not include the taxpayer’s basis. This means taxpayers will need to maintain complete records of their digital asset activity to calculate capital gains or losses correctly.

Tax professionals should:

- Track acquisition and sale dates

- Maintain cost basis records for each asset

- Identify the method used (FIFO, LIFO, or Specific Identification)

- Document every taxable event such as swaps or conversions

Clients who fail to maintain these records may face inaccurate reporting and potential penalties.

Transactions Currently Excluded

Not all digital asset activity will be reported at first.

Exclusions include:

- DeFi staking and lending

- Wrapping and unwrapping transactions

- Liquidity pool activities

The IRS plans to issue future guidance on these areas. Tax professionals should still track these transactions because they may become reportable later.

Preparatory Steps for Tax Professionals

The new rules will increase the workload for tax professionals who manage digital asset reporting. Early preparation is key.

Practical steps to take in 2025:

- Review client holdings: Map out all exchanges and wallets your clients use.

- Fill data gaps: Reconcile missing or incomplete records.

- Set a cost basis method: Decide and apply a consistent approach (FIFO, LIFO, or Specific Identification).

- Categorize taxable events: Flag disposals, swaps, and conversions for proper reporting.

- Use secure software: Handle sensitive data carefully and ensure compliance with IRS standards.

- Educate clients: Help them understand why they need to maintain records even if they don’t receive a 1099-DA right away.

By doing these steps early, professionals can avoid last-minute issues once reporting becomes fully active in 2026.

Additional Compliance and Due Diligence

Along with transaction reporting, other areas need attention:

- Update W-9 or W-8 forms: Make sure client information is correct and up to date before 2026.

- Check reporting systems: Identify any gaps in current digital asset tracking tools.

- Monitor IRS updates: Stay informed about transitional relief under IRS Notice 2024-56 and Revenue Procedure 2024-28.

Keeping these administrative details in order will reduce errors and penalties.

Professional Insight

Form 1099-DA is a major step toward modernizing how the U.S. tax system deals with digital assets. It mirrors how stock brokers report trades using 1099-B, making crypto more mainstream in tax compliance.

For tax professionals, the key takeaway is to:

- Start tracking digital asset transactions now

- Educate clients on proper recordkeeping

- Establish clean and consistent audit trails

- Prepare for detailed reporting in 2026

Those who act early will not only protect their clients from penalties but also strengthen their advisory role as digital assets become more regulated.

How Form1099online.com Can Help

Form1099online.com is an IRS-authorized platform for filing 1099 forms online. As reporting requirements expand to include digital assets, this platform can make compliance faster and more accurate by:

- Supporting easy preparation and e-filing of 1099 forms

- Ensuring IRS-authorized submission and confirmation

- Reducing errors through guided form completion

- Securing sensitive financial and digital asset data

Tax professionals can use the platform to manage reporting for multiple clients in one place, saving time during filing season.

Conclusion

The introduction of Form 1099-DA signals a clear shift in how digital asset transactions will be reported to the IRS. Brokers will begin reporting from January 1, 2025, and taxpayers will receive their first 1099-DA statements in early 2026.

For tax professionals, this is the time to prepare. By setting up accurate recordkeeping, educating clients, and using secure e-filing platforms, they can ensure full compliance and smooth reporting.

Digital assets are no longer a grey area in tax reporting. With these new rules, clarity and accountability will be the standard.